Online currency brokerages played a vital role throughout the COVID-19 pandemic. At a time when banks and other financial institutions were forced to close their doors to customers, tens of millions of people had to scramble and find online alternatives to transfer money to friends and family across the world.

Currency brokerages managed to keep up with the surge of demand and are now operating under the assumption the shift to digital is here to stay. This is great news for people looking to work at one of the 30+ currency brokerages just in London and many of their support offices across the UK and the world.

What Does A Currency Broker Do?

A currency broker, also referred to as a money transfer service or forex broker, simply facilitates the transfer of money across borders. Most transactions involve exchanging one currency for another, such as British pounds to euros.

Users of currency brokers range from individuals transferring as little as a few pounds to corporate clients that transfer tens of millions of pounds, if not more, on a regular basis.

Most currency brokers offer value-added and additional services, although this is mostly exclusive to corporate clients that require more complex products and solutions.

Industry Growth Means Job Growth

The global money exchange industry experienced impressive levels of growth heading into 2020 as consumers and corporate clients wanted a simpler, cheaper, and more convenient way to transfer money.

To say that the COVID-19 pandemic resulted in industry growth would be inaccurate. Rather, the pandemic accelerated growth from existing and new clients. U.S.-based PayPal Chief Financial Officer John Rainey said last May that people over 50 years old represented its fastest-growing market and this trend was easily observable worldwide.

To address the surge in demand that is likely to remain permanent, many UK-based foreign exchange companies are looking for talented workers to join their teams.

As is always the case, companies recruit in different ways. Some advertise open vacancies directly on their website, others use third-party websites like Indeed or LinkedIn. Other companies encourage job seekers to email a copy of their resume to their recruiting department.

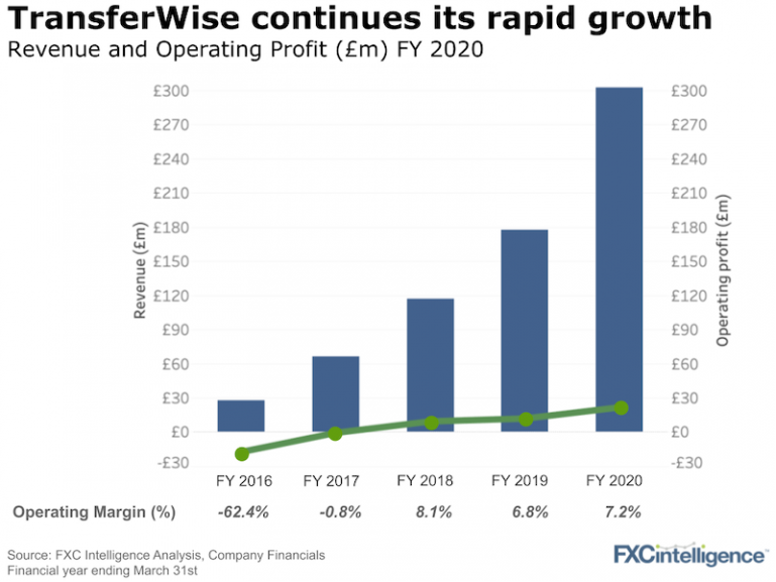

TransferWise, as one example, stated in a press release it is adding 750 currency brokerage jobs worldwide over the next six months, including many in its home base of London. But this is “just the beginning” of a recruiting campaign as its current team of 2,200 people isn’t large enough to realize growth objectives.

Smaller but fast-growing companies like WorldFirst still have more than a dozen job vacancies on its website for its London office.

Skills And Talents Vary By Job

What skills and talents are needed to work at one of the dozens of currency brokerages in London and elsewhere? There is no one simple answer as it depends on the level of experience and position.

Some job openings require expert knowledge with many years of experience in the field. Others require little to no knowledge of the global exchange industry.

For example, a real job posting at a major currency exchange firm for a Senior Product Manager for Banks requires a candidate with experience in building one or more successful products that large banks use in their foreign exchange business. The salary for this position is not disclosed but it would be reasonable to assume it is in the six-digits along with attractive bonuses and other rewards.

At the other extreme, a real job posting at another major firm is looking for an expert Salesforce developer. The most important skills the hiring company is looking for is extensive experience in Salesforce languages like Apex, SOQL, and Lightning. Anything above a basic level of understanding of the foreign exchange market is likely not required.

Entry Level Jobs: A Great Starting Point

Entry-level jobs are a great starting point for young workers looking to work hard and grow professionally over the years. The currency brokerage industry is a fantastic industry to work in as it will be growing for many years to come.

Companies love to promote from within so hard-working individuals that go above and beyond their duty will be first in line to move up.

Customer service is a job that is typically associated with dealing with frustrated and rude clients that don’t understand the product or service they are paying for. But it is among the most important jobs in a fast-growing company because it deals with keeping customers happy and solving problems. It also forces new workers to understand the importance of hard work and dedication.

To best prepare for a job in customer service at an FX brokerage firm, you need to first and foremost understand the industry. Be prepared to answer common questions like “why hasn’t my transfer been completed yet” or “I thought I would get more pounds from my Canadian dollar transfer.”

Conclusion: More Than Just A Salary

It goes without saying that salary is a very important factor in determining what job you select. Most of the currency brokerage firms are competing with each other in salary and in many cases, people accept lower pay for better perks.

Some of the perks that leading FX brokers should offer for talented workers include company pension, private health cover, and at least 25 days of holiday.

For many people, an exciting, modern, and fun work environment is just as important. When it is safe to return to the office, many people will only work in an office that offers perks like free breakfast and snacks, corporate parties, and a family-like environment that is designed to support each other in a respectful way.